Economic conversations rarely come with clean answers—and that was precisely the point of the latest Gwinnett Chamber On Topic luncheon, presented by Porter Steel. Business leaders from across Gwinnett and the Atlanta metro gathered for a timely discussion with Raphael Bostic, President and CEO of the Federal Reserve Bank of Atlanta, for a candid look at where the economy stands and how leaders should think about what comes next.

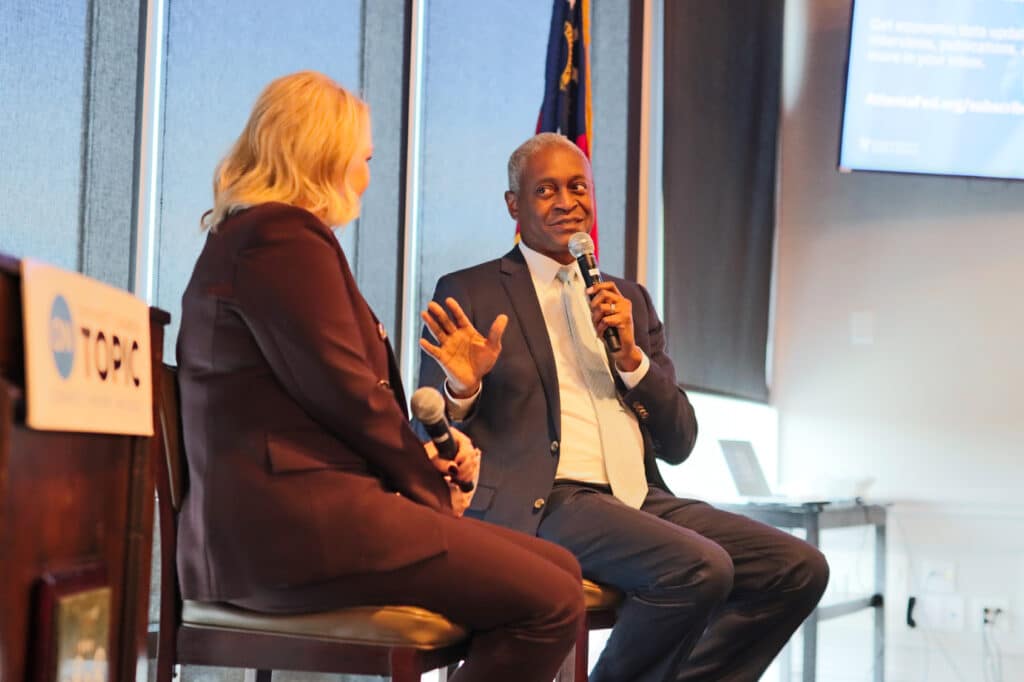

Moderated by Kim Hartsock, the 2026 Gwinnett Chamber Board of Directors Chair, the conversation carried added significance as Dr. Bostic recently announced his retirement, making this one of his final public appearances — an opportunity for both reflection and clear-eyed realism.

He began with perspective. Retirement, Dr. Bostic explained, is often about timing. When an institution is strong, leadership is capable, and culture is healthy, it may be time to step back. He expressed confidence that the Federal Reserve Bank of Atlanta is well positioned, supported by strong leaders and a clear understanding of how work gets done. Looking ahead personally, he shared plans for global travel and birdwatching, an interest that reflects his patient, observant approach to leadership.

That theme carried into a broader discussion of leadership itself. One of the things Dr. Bostic said he wished he had fully appreciated when taking the role was the constant visibility that comes with leadership. Leaders are always being watched — not just in the office, but everywhere. The job requires presence, adaptability, and intentional use of energy, day after day.

Those same qualities shape how the Federal Reserve approaches economic policy. In today’s environment, Dr. Bostic noted, conditions evolve rapidly. Relying on prior-month data to forecast what comes next is increasingly unreliable. This is where conversations with business leaders matter most. Hearing directly from companies across Gwinnett and the Atlanta metro provides real-time insight that helps distinguish signal from noise in a fast-moving economy.

Despite recent headwinds, from the pandemic to global conflict and trade tensions, Dr. Bostic pointed to continued resilience. GDP growth remains solid, and consumer spending has not meaningfully declined. Looking ahead to 2026, he anticipates continued spending momentum, supported in part by tax legislation passed over the summer, with stimulus effects expected to emerge in late winter and contribute to economic activity in the second quarter.

Challenges remain, particularly around inflation and the labor market. Of the two, inflation is furthest from target and the greater concern. Employment, while cooling, is not weakening. Unemployment has risen from historic lows near 3 percent to the mid-4 percent range, but layoffs today are often driven by efficiency gains, technology adoption, and organizational restructuring — not declining demand.

Dr. Bostic emphasized that determining whether the labor market is “strong” or “weak” has become more complex. Structural factors such as demographics, immigration, productivity, and workforce participation influence outcomes in ways not always visible in headline numbers. These dynamics explain why labor data can send mixed signals without pointing to economic deterioration.

What makes the current moment distinct, he explained, is complexity. Risks to both sides of the Federal Reserve’s dual mandate—employment and inflation — do not occur often. Yet textbooks have long acknowledged that central banking is inherently difficult because those forces are almost always in tension. As Dr. Bostic put it plainly, “I get paid to worry.”

He also underscored the importance of the Federal Reserve’s independence. Monetary policy is made with a five- to ten-year horizon in mind, guided by long-term economic stability rather than short-term political pressures. That independence allows the Fed to remain constant to its mandate — providing credibility and consistency for businesses planning for the future. Despite uncertainty, he expressed confidence that the American people continue to trust the Federal Reserve to do its job.

The luncheon offered Gwinnett’s business community more than an economic forecast. It provided context, perspective, and a reminder of why informed dialogue between business and policy leaders matters. Future On Topic Luncheons can be found on the Gwinnett Chamber’s event calendar.